Benefits Education

HDHP vs. PPO Medical Plans – What’s The Difference?

HDHP Medical Plan

(High-Deductible Health Plan)

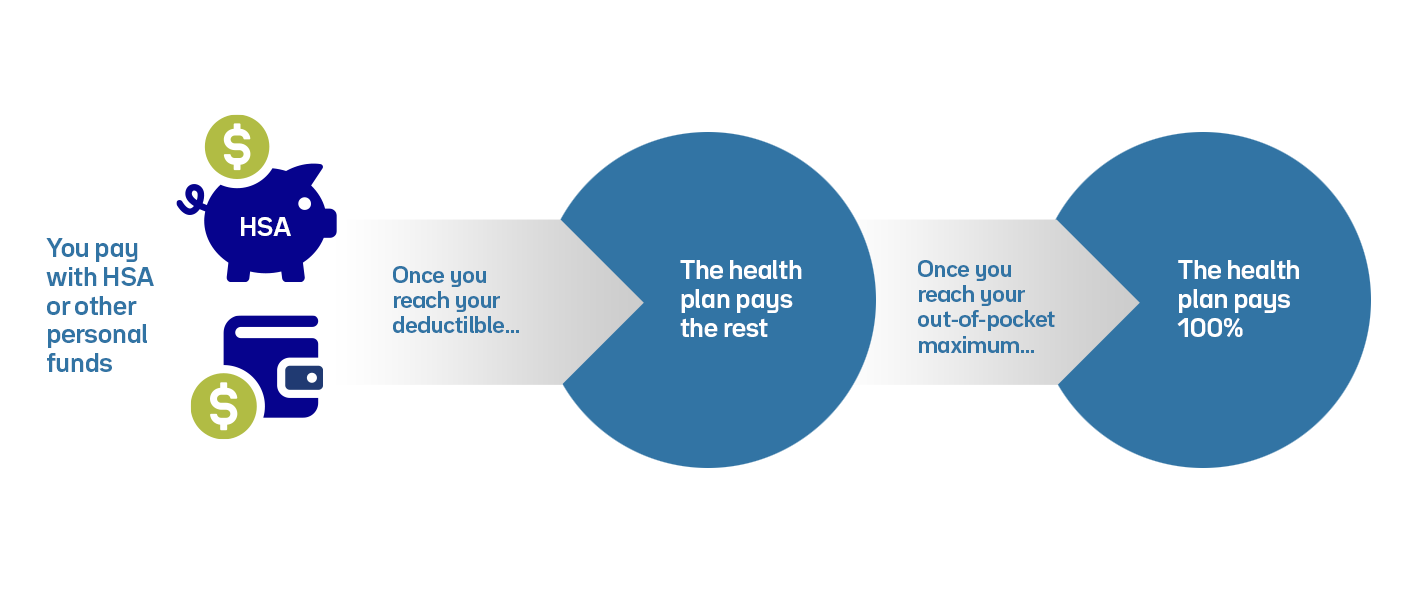

- HDHPs typically have lower monthly premiums than traditional plans like PPOs, making them more budget-friendly for those who don’t expect frequent medical care.

- The annual deductible is typically higher, meaning you pay more out of pocket before the insurance begins to cover costs. Once the deductible is met, the plan will typically cover a large portion of eligible medical costs.

- HDHP - High plan (higher premium cost / lower out-of-pocket deductible)

- HDHP - Low plan (lower premium cost / higher out-of-pocket deductible)

- Selecting in-network providers will always offer you the best coverage and discounts.

- In-network preventive care services are 100% covered.

- Keep money in your pocket with a Health Savings Account (HSA)

- HDHP plans give you access to an HSA which lets you set aside pre-tax dollars to pay for eligible medical, dental, or vision expenses, and even some over-the-counter items.

- Werfen offers a Company-paid HSA contribution to help your savings grow.

- The HSA provides tax-deductible contributions, you can invest funds for tax-free growth, and you can withdraw funds tax-free for qualified expenses.

- Your HSA funds are yours to keep with no expiration and can be carried job-to-job!

PPO Medical Plan

(Preferred Provider Organization)

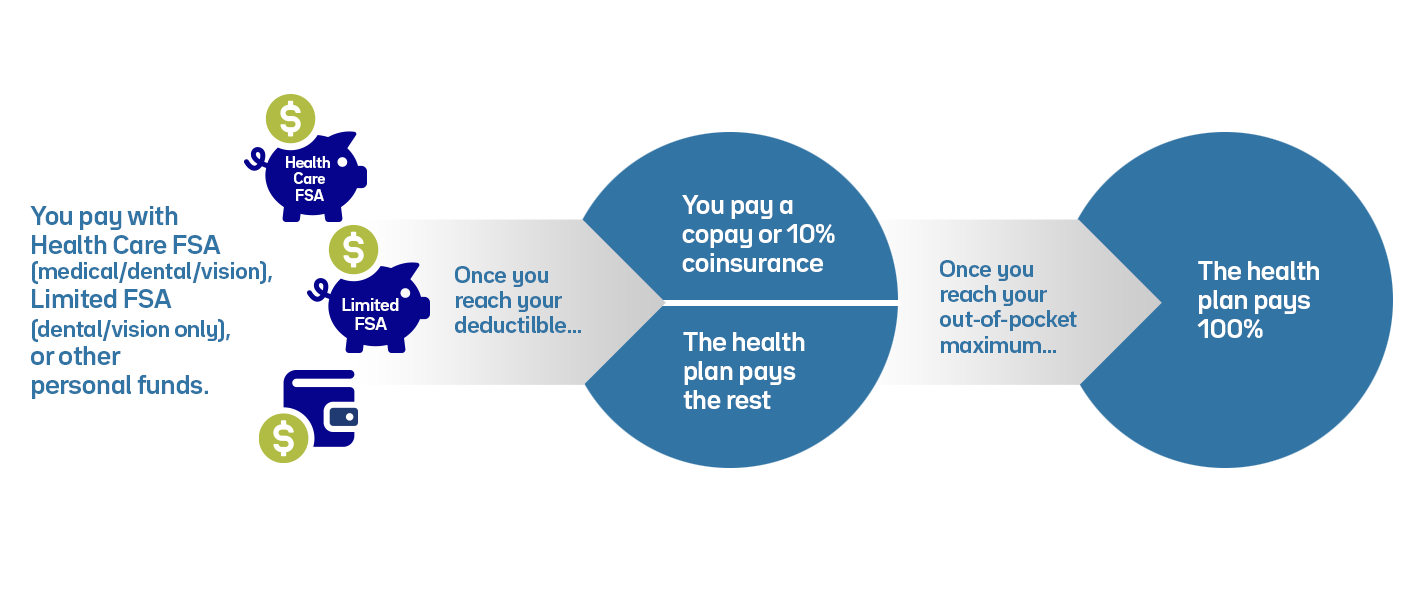

- In contrast to a HDHP plan, a PPO plan has a lower annual deductible, but higher monthly premiums, which means your coverage starts to cover a large portion of eligible medical costs much sooner (once the deductible is met).

- Unlike HDHPs, PPOs have fixed copays for care making it easier to budget for those who have more frequent doctor visits, prescriptions, and specialist care.

- Core Plan PPO Plan

- Enhanced PPO Plan (current enrollees only)

- You can benefit from a larger, more flexible provider network, including both in-network and out-of-network care. Referrals are not required for specialist care.

- In-network preventive care services are 100% covered.

- Keep money in your pocket with a Flexible Spending Account (FSA)

- PPOs are often paired with FSAs which let you set aside pre-tax dollars to pay for eligible medical, dental, or vision expenses, and even some over-the-counter items.

- Your elected annual FSA election amount is available in full on January 1, which can help cover large or unexpected medical costs early on.

- FSA funds are use it or lose each year! Re-enrollment is required each year.

Get High-Quality Care Without Traveling or Waiting

Skip the waiting room and see a doctor right away.

Each Werfen medical plan includes 24/7/365 virtual care services. This benefit is available to medical plan enrollees and covered dependents.

-

Virtual visits are often less expensive than in-person appointments.

- Avoid urgent care and ER visits for minor issues.

- Log in from home or on the go with no travel time, parking, or waiting.

- Confidentially connect with multilingual, diverse providers.

- If necessary, you can also find a primary care provider (PCP).

Is a virtual care visit right for you?

Get quick relief from common minor conditions such as cold/flu symptoms, fever, runny nose, sinus pain, sore throat, headaches/migraines, stomach issues, allergies, and skin issues.

Talk to a mental health professional about topics such as stress, depression, anxiety, substance abuse, grief, emotional trauma, and behavioral health symptoms.

Ready to get started?

Connect with your medical provider or call Health Advocate to learn more.

NOTE: Virtual care services are not recommended for emergency situations.

Take 5 Minutes to Check Your Beneficiaries

Designating beneficiaries is a crucial step in estate planning.

Regardless of what your legal will states, your beneficiary designations determine the specific individual(s) who will inherit your assets and certain benefits if you were to pass away.

- Directs Your Assets Instantly - Your beneficiary designation ensures that your money goes exactly where you intend without going through a court probate process and with fewer legal headaches.

- Overrides Your Will - Beneficiary designations are contractual agreements between you and the financial institution holding the asset. If the person named on a beneficiary form is different from the person specified in your legal will to inherit that asset, the beneficiary designation takes precedence.

- Big Life Changes = Big Impact - Marriage, divorce, new baby, death of a loved one. Any of these life events can throw your beneficiary plan out of sync if you don’t update it. It's crucial to coordinate and review your beneficiary designations regularly after significant life events

Set a reminder to review your beneficiary designations at least twice a year. If you're enrolled in one of these plans, be sure to check each one separately:

- Basic and Supplemental Life Insurance – log into ADP.

- 401(k) Retirement Savings Plan – log into T. Rowe Price.

Are You Making the Most of Your 401(k)?

Planning for retirement doesn’t have to be overwhelming.

Your future self will thank you for taking just a few minutes to review your retirement savings plan — one of the most valuable benefits we offer!

- Our 401(k) plan allows U.S. employees to set aside up to 75% of your income up to the IRS annual limits.

- Ensure that you're contributing enough to maximize Werfen’s Company-paid 401(k) match — this is a dollar-for-dollar match up to the first 8% of your eligible pay.

You don’t have to plan for retirement alone.

A targeted 401(k) investment strategy will help you grow your nest egg, give you tax breaks, and increase your earnings.

Simplify financial planning with FREE assistance from a licensed T.Rowe Price adviser.

|

What is a Qualifying Life Event?A qualifying life event is a significant change in your life circumstances, such as getting married, having a child, or losing a job, that allows you to make changes to your benefits outside of the annual U.S. Open Enrollment period.Mid-year benefit change requests must be submitted through ADP within 30 days of the event with supporting documentation. |